Company Update / Telecommunications / IJ / Click here for full PDF version

Author(s): Giovanni Dustin ; Ryan Dimitry

- 's share price has declined by -28%, as concerns on competition and performance was exacerbated by the unfavorable macro backdrop.

- We believe that concerns on competition and /Tsel's performance are overblown. Of note, ARPU could potentially bottom-out in 1Q24.

- 's risk/reward profile looks favorable, in our view; reaffirm Buy.

's share price saw severe deterioration

Since our sector report at end-Mar24 (see our previous note), share prices of /ISAT have largely stabilized (+5%/flat), which we believe is attributable to a combination of upbeat expectations on 1Q24 results, potential corporate actions, and index inclusion. On the other hand, 's share price continued to deteriorate further (another -12%, for a total of -28% since mid-Mar24) as concerns on competition and operational performance were exacerbated by the unfavorable macro backdrop. Notably, has the highest foreign holding among its peers, and thus, weaker US$/Rp generated sizable outflow.

Operational performance could potentially continue to improve supported by benign competition; outflow pressure may subside

First, we continue to believe that the competitive landscape seems likely to remain favorable, as: 1) Tsel Lite looks optically aggressive but is generally ARPU -accretive; and 2) we see limited incentives for telcos to resort to aggressive pricings in a bid to capture near-term market share (see our previous note). Second, against this backdrop, we expect Tsel (mobile-only) to see better revenue growth of +3% yoy this year (vs. flat yoy in FY23) supported by ARPU improvement. We believe that Tsel's ARPU seems likely to bottom-out in 1Q24 driven by price hikes and uptrading (see our previous note). We also penciled-in +3% topline and EBITDA growth for (vs. +1/-2% yoy in FY23). Third, outflow pressure could potentially start to ease, as 's institutional investors holding is now at the lowest level since FY17 and higher 7-DRR rate should help to cap US$/Rp downside risks (see our economists' note). Also, recall that actually fares better against the potential rate upcycles and stronger US$ (see our previous note).

Current valuation implies limited downside risk

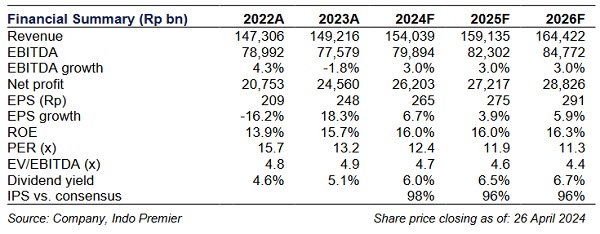

Finally, considering: 1) 's share price has dropped by -28% since mid-Mar24; and 2) consensus' EBITDA/earnings cut of 5/6% YTD along with FY24F EV/EBITDA of 4.3x (-2SD of its mean) - the level where its share price bottomed during the pandemic, and at 6.5% dividend yield (assuming 80% payout) - a 10-year high, we think that most of the concerns are likely already priced-in. Further, its valuation gap to /ISAT have narrowed (c.2% premium/13% discount vs. c.18% premium/43% premium historically). Thus, we believe that 's risk/reward profile looks attractive now.

Maintain Buy, with an unchanged TP of Rp4,200

Although we continue to prefer and on better growth trajectories and re-rating potentials, we believe that 's risk/reward profile looks favorable at current valuation (4.4x FY24F EV/EBITDA and 6.5% yield). As such, we maintain Buy on with a blended valuation-based (DCF and EV/EBITDA multiple) TP of Rp4,200. Downside risk is intensifying competition.

Sumber : IPS